GCash Cash-in Convenience Fee is for Payment Partners

The GCash Cash-in Convenience Fee is not really about GCash charging us consumers in order to use their app. The convenience fees are actually for the payment partners. Read more about it.

GCash services are still free. It's the payment partners that are charging the GCash Cash-in Convenience Fee.

Have you read of the recent news about the GCash Cash-in Convenience Fee? Well, it’s not really about GCash charging us consumers in order to use their app. The convenience fees are actually for the payment partners. Read more about it.

The GCash Cash-in Convenience Fee

GCash recently announced a new convenience fee for cashing in using the linked Visa or MasterCard bank cards. The fees will be implemented starting July 6, 2020 and will amount to 2.58% of the total amount to be cashed in for every transaction. Yes, it’s not a set fee but a percentage of the total transaction.

Contrary to what people believe, the fee is actually the direct charge of GCash’s card payment partners. All the fees collected will go directly to the

card payment partners of GCash. This means that GCash does not earn from the 2.58% convenience fee that will be levied on the consumers per transaction.

GCash Still Gives Free Service

If not for the recent increase in the charges implemented by their card payment partners, GCash services remain free. GCash will not be passing on any convenience fee on their cash-in via Visa/MasterCard bank card service.

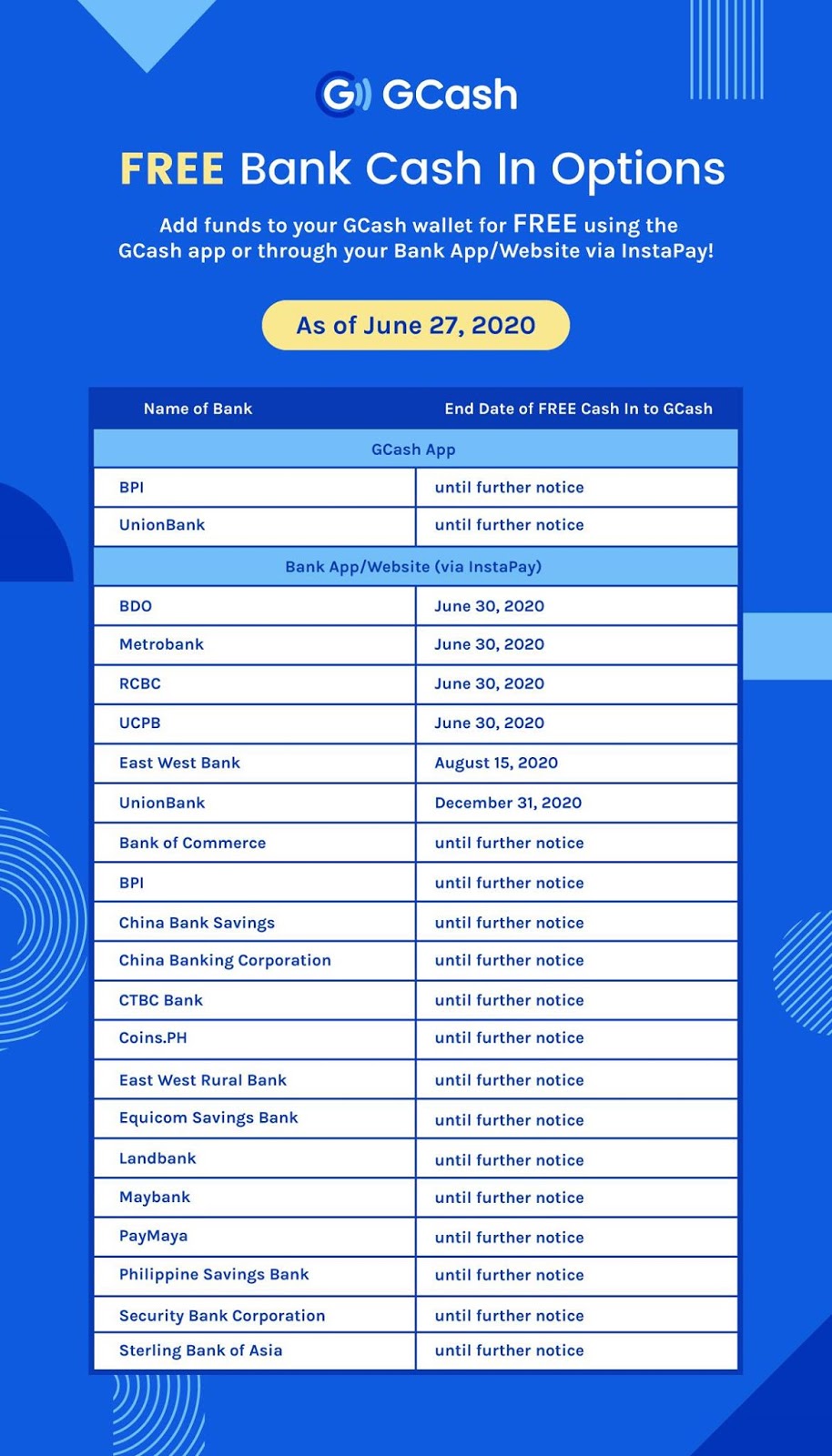

Meanwhile, GCash is still providing other cash-in methods that are totally FREE. These are Cash-in transactions via linked BPI or UnionBank accounts. Or you may use a bank app or website powered by InstaPay.

So don’t blame the app for the new GCash Cash-in Convenience Fee that will be charged soon. It’s not the fault of GCash because they still try to give us good value service for free.

Remember, the Pass-on fees by GCash’s card payment partners will be implemented on July 6, 2020.

Payment Partners

Here is the list of GCash payment partners as well as the other schedules of the implementation of the cash-in fees.

GCash: The Most Competitive Mobile Wallet

As such, GCash is still the most competitive mobile wallet in the market considering the charges. And here are the reasons why:

- The fee is still lower than other mobile wallets where a flat rate of P30 is charged for each transaction. This applies even for cash-in transactions below P1,000.

- 70,000 partner merchants nationwide accept GCash as payments

- Free cash-ins to customer with linked bank accounts or via InstaPay network

- Multiple value added services such as GCredit, GSave, and GInvest

- Convenient payment of bills through GCash Pay Bills

- Bank money transfers available through GCash Bank Transfers

GCash is still very effective and convenient. If you don’t want to pay the convenience fees, the best alternative would be to change banks. Thankfully, we have one week to prepare for the changes in our online banking habits.

Gcash is very useful app nowadays. It is very efficient and effective way of transferring money to one another. This information is very helpful, thanks for sharing.

Gcash is one of the easiest app to use when it comes to cashless transaction/money transfering.